National Assembly rejects 5 per cent tax on infrastructure bonds interest

The Treasury had projected that taxing infrastructure bond interest would generate Sh13 billion annually, a crucial part of its efforts to raise Sh174 billion in additional revenue.

Members of Parliament have rejected a proposal by the Treasury to impose a five per cent withholding tax on interest earned from infrastructure bonds, marking a significant blow to the government's revenue-raising plans.

The tax proposal was part of the Tax Laws (Amendment) Bill, 2024, which sought to remove the tax exemption that has applied to infrastructure bonds since their introduction in 2009. If approved, this would have been the first time such bonds were subject to taxation.

More To Read

- Weak taxation of wealthy costs Kenya Sh130 billion annually, report finds

- Report warns withholding tax risks pushing digital traders to informal platforms

- Kenya to launch National Infrastructure Fund to cut reliance on external borrowing

- Kenya losing over Sh79 billion annually to undervalued imports, says NTA

- CS Chirchir defends Sh175 billion infrastructure bond, assures it won’t raise public debt

- Murkomen vows crackdown on ex-security officers forming armed political groups

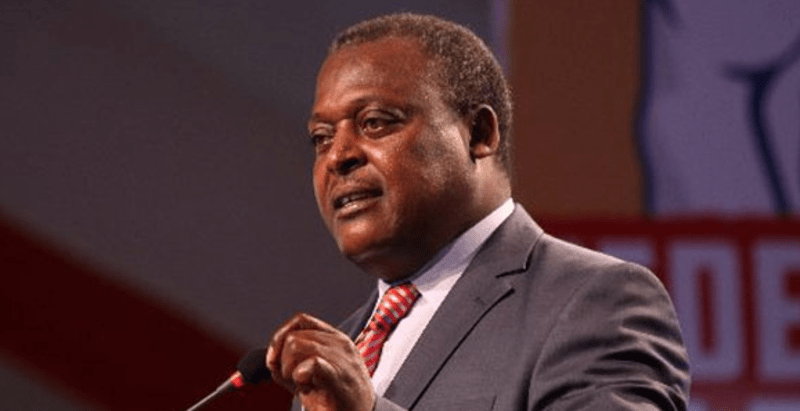

Chair of the Departmental Committee on Finance and National Planning, Kuria Kimani on Wednesday defended the decision to reject the tax measure, noting the importance of encouraging investments in Kenya, particularly in green bonds.

"I move that Clause 14 be amended as per the order paper. (I propose) to retain the provision on bonds which are exempt from income tax, which will encourage investment in Kenya, especially in green bonds which promote protection of the environment," said Kimani.

"This is where we're deleting the proposed withholding tax on infrastructure bonds," he added.

The Treasury had projected that taxing infrastructure bond interest would generate Sh13 billion annually, a crucial part of its efforts to raise Sh174 billion in additional revenue.

Deter investor interest

However, stakeholders warned that the new tax measure could deter investor interest in infrastructure bonds, raise the cost of infrastructure projects, and ultimately hinder the government's development goals.

The rejection of the proposal now compels the Treasury to explore alternative funding sources.

The Tax Laws (Amendment) Bill, 2024, was among several bills introduced to Parliament as part of a broader fiscal strategy.

Other related bills include the Tax Procedures (Amendment) Bill, 2024, and the Public Finance (Amendment) Bill, 2024.

Top Stories Today